The End of Asset Allocation?

If you find yourself reacting to the news… you might not be doing it right. It is much more useful (and profitable) to anticipate trends in advance than it is to respond to the morning’s headlines.

When people talk about investments at cocktails parties or social gatherings, the conversation almost always veers towards “How do you believe that X will influence Y?”

The “X” in this case is always the hottest news item, and “Y” is typically the investment that is receiving the most press coverage.

Watching CNBC or Bloomberg News, you’ll get a good sense of the market’s mood for that moment . Market commentators will scramble to explain why today’s big story is moving the markets. When a story occurs for several days (or weeks) in a row, it becomes a source of public obsession. Eventually, that story becomes the most important thing moving the markets. Everyone becomes an expert in understanding the topic at hand, until the issue is resolved and the markets move to a new narrative.

It is worth mentioning that portfolio managers have relatively little control over client returns. If it was easy to control returns, we would always choose to generate spectacular profits. Right? Investing would become tedious, because everyone would have equally amazing performance.

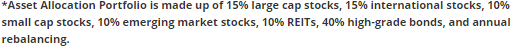

What can be controlled is exposure to opportunity and risk. And the traditional way of doing this is through something called "asset allocation", which is part of a much bigger framework known as Modern Portfolio Theory (MPT).

The principle is fairly straightforward. By putting together a portfolio of non-correlated assets, you can hypothetically create smoother returns for investors.

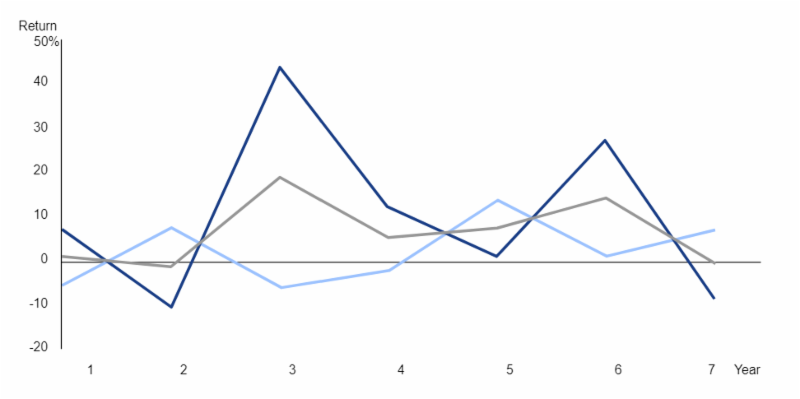

In the example above, we compare the performance of the S&P 500 index (dark blue) with the 20-year U.S. Treasury Bond (light blue). The middle line represents a balanced portfolio which is equally invested in both. The time period illustrated is 1956-1962, shortly after Modern Portfolio Theory was developed by Harry Markowitz in The Journal of Finance.

It was a beautiful and elegant idea. Asset allocation created a new standard for the industry and is still in use today.

One of the useful things about asset allocation was that it enabled financial advisors to be agnostic about the financial markets. It was no longer considered necessary to anticipate (or respond) to the news. All the advisor needed to do was "stay the course" and periodically rebalance portfolios to a target allocation.

Meanwhile, investors had less portfolio volatility. Mutual funds had lower asset turnover, because investors stayed invested for longer periods of time.

This was the real genius behind asset allocation. It kept everyone happy (for a while).

The Limits of Asset Allocation

As a portfolio manager, I started to see the limitations of asset allocation during the Financial Crisis of 2008-2009. During that period not only did the S&P 500 lose half its value, but bonds were down, real estate was down, and commodities were down. "Winning" simply meant "losing less." The only major asset class that didn't lose value was... cash.

Now that the S&P 500 is over 10% off from its peak levels earlier this year, we are seeing similar parallels. Many traditional asset classes are becoming correlated - right when we want the benefits of diversification.

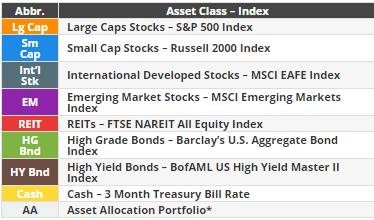

In the chart above, all major financial asset classes show some correlation to the S&P 500. There is a slightly negative correlation between the Barclays Aggregate Bond index and the MSCI Emerging Market index. Beyond that, everything else "sinks or swims" together.

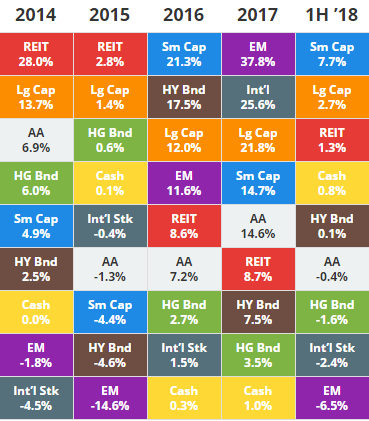

Furthermore, the S&P 500 consistently outperformed most other asset classes over the past five years (and for the first half of this year). Attempts to diversify against U.S. market risk have generally produced performance lag, especially for those portfolios holding exposure to international and emerging market stocks. Bonds have lagged more recently, as a result of higher interest rates.

Source: www.novelinvestor.com

This isn't saying that asset allocation is dead. If the current market correction evolves into a typical bear market, investors using some form of asset allocation may see less downside.

My sense is that asset allocation may be inadequate on a stand-alone basis. People are starting to figure this out. There are other useful tools of risk management, and these include style/sector rotation, investment selection, hedged strategies, and market timing. This is a benefit of having an independent investment advisor for your portfolio, as traditional index funds don't do any of these things.

Jim Lee, CFA, CMT, CFP ®

Disclosure: Information contained herein is for educational purposes only and is not to be considered a recommendation to buy or sell any security or investment advice. Securities listed herein are for illustrative purposes only and are not to be considered a recommendation.