The Disruption of Finance

As a futurist, I spend much of of my time thinking about "what happens next?" In this article, I'll share an insider's view of the finance industry. Much has changed in the past 25 years, and it's been exciting to watch.

Let's start with the existing trends first, followed by some of the new stuff:

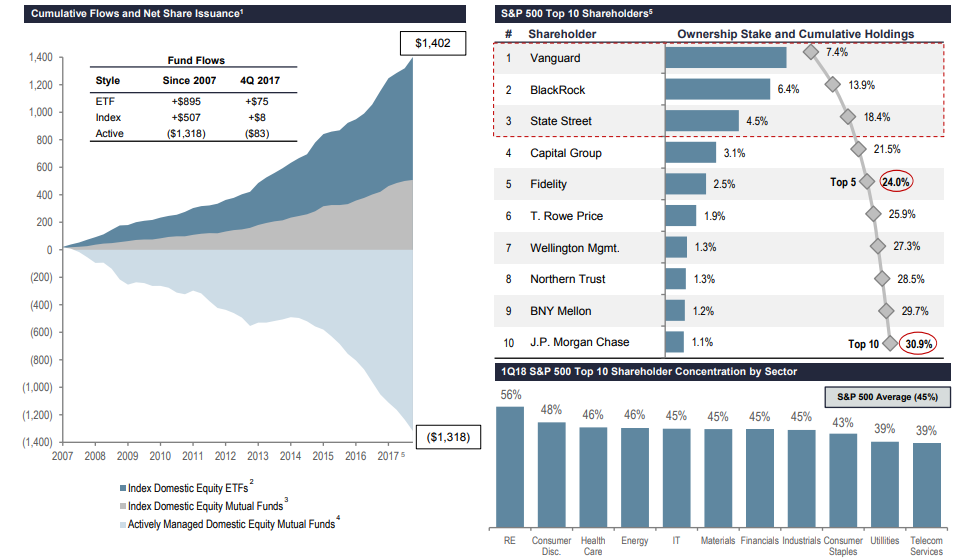

1) Rise in popularity of index investing. There is extreme price compression going on in commoditized asset management. It truly is a race to the bottom. Some index funds now carry annualized fees as low as 0.04%. This is beginning to translate into fee compression for traditional active managers.

This is also translating into so-called "economies of scale" - bigger companies are getting more competitive, in part, because they can charges lower fees.

Meanwhile, conventional mutual funds are bleeding assets, while the bulk of new inflows are going to a handful of Index providers, primarily those offering Exchanged Traded Funds (ETFs).

Source:FactSet, P&I and Simfund as of 03/31/2018.

The irony here, is that big fund companies such as Vanguard and Blackrock may be the ultimate beneficiaries from the rise of robo-advisors (which tend to rely heavily on index funds). The top ten asset managers now own roughly 30% of all the companies represented in the S&P 500 index.

2) Because of the dominance of indexing strategies, stock selection is going somewhat out of favor for the general public. Investment management is becoming more about understanding and tracking the exposures that your companies correlate to, and less about the companies themselves. Think about that.

For sophisticated investors, privately managed equity portfolios continue to offer tax efficiency, along with the ability to customize accounts according to individual preferences.

3) Automation disrupted the investment research world a while ago. I run into quite a few former analysts / portfolio managers that were outsourced to algorithms. A regional bank a few blocks away from the StratFI office almost entirely liquidated its staff of analysts back in the mid 2000's.

Just last January, the AI Powered Equity ETF (ticker: AIEQ) was introduced, using IBM's Watson to actively manage stock selection. This will be fascinating to watch.

4) Indexing -> smart indexing -> active management of smart indexing strategies

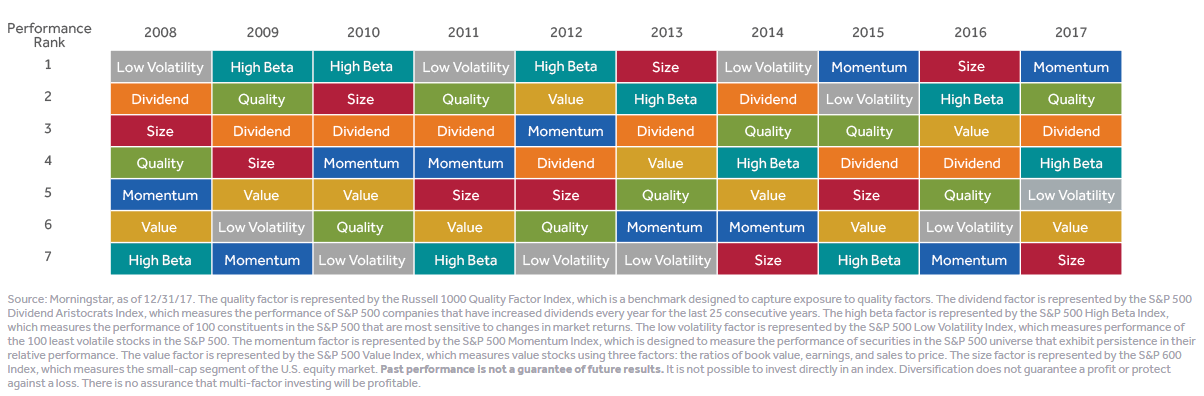

A few years ago, we saw a boom in smart beta ETFs, which focus on various "factors" (value, momentum, quality, etc.) that appear to provide superior performance characteristics over time. As any expert would tell you, these factors come and go out of favor.

So, the new, new thing would be strategies that actively switch between those factors. Oppenheimer funds started its own Oppenheimer Russell Dynamic Multifactor ETF (OMFL) and Vanguard is following up with its own multifactor ETF (VFMF).

These strategies blend active management with algorithmic enhancement to traditional indexed strategies. How "meta" is that?

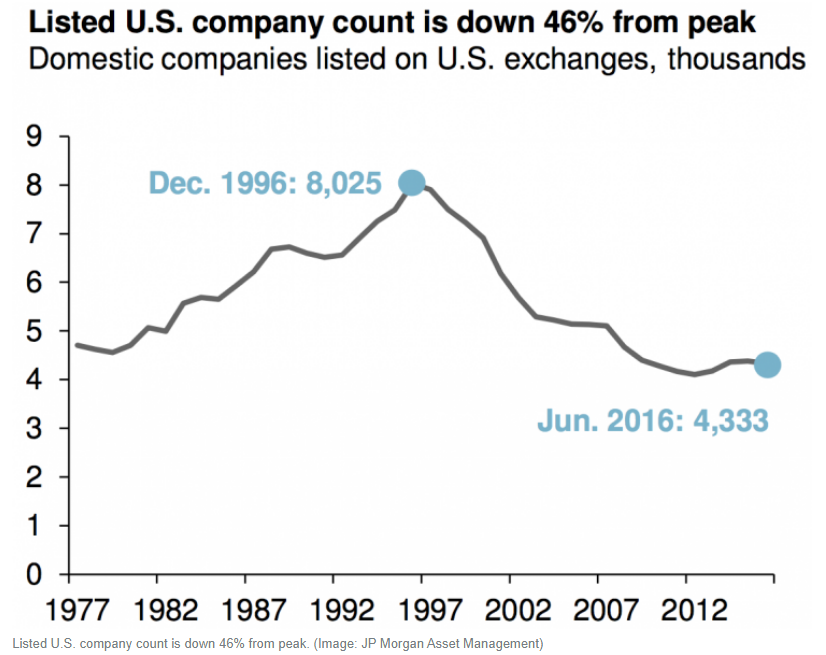

5) The headaches of regulatory oversight are contributing to a decline in the number of publicly-traded companies within the U.S. These figures peaked shortly before the adoption of Regulation FD (2000) and Sarbanes-Oxley (2002).

It is much more appealing to be a privately owned and funded company now, especially with an abundance of venture capital. Easy money, less regulation, what's not to like?

Many companies are waiting much longer before having their IPO, with initial public offerings now more of an exit strategy than a funding mechanism. The result is a narrower set of opportunities for public investors.

6) Blockchain technologies pose a competitive threat to traditional financial institutions. Blockchain/crypto-currencies already provide alternatives for funding, trading, and cash transfer. Financial intermediaries run the risk of becoming disintermediated.

Initial Coin Offerings (ICOs), those bizarre love children of crowdfunding and IPOs, have already raised more than $9B this year. While crypto-currencies boomed in a "Wild-West" environment, further adoption will necessitate some further regulatory oversight.

(Trends #6 and #7 highlight the problems of "too much" vs. "too little" regulation, and the complexities of managing change.)

7) When the stock market (eventually) goes into bear mode - index funds are likely to get sold first. It is how flash-crashes happen. Many ETFs are not going to be as liquid as people think, periodically trading at steep discounts to net asset value. This will create a counter-trend opportunity for active managers.

8) The future of advice. You'll want to be sure that your financial advisor can keep up with the times.

The trend seems to be moving towards bigger money managers offering a less personalized experience. Some financial advisors are going into full "robo" mode, while others are more focused on "soft" services such as life coaching. At StratFI, we provide leading-edge investment advice with personal access.

Our offerings continue to evolve rapidly. Feel free to give us a call or send an email if you'd like to learn more.

James H. Lee, CFA, CMT, CFP®

(302) 884-6742

Disclosure: Information contained herein is for educational purposes only and is not to be considered a recommendation to buy or sell any security or investment advice. The advisor may hold shares of OMFL and AIEQ within client accounts. Securities listed herein are for illustrative purposes only and are not to be considered a recommendation.